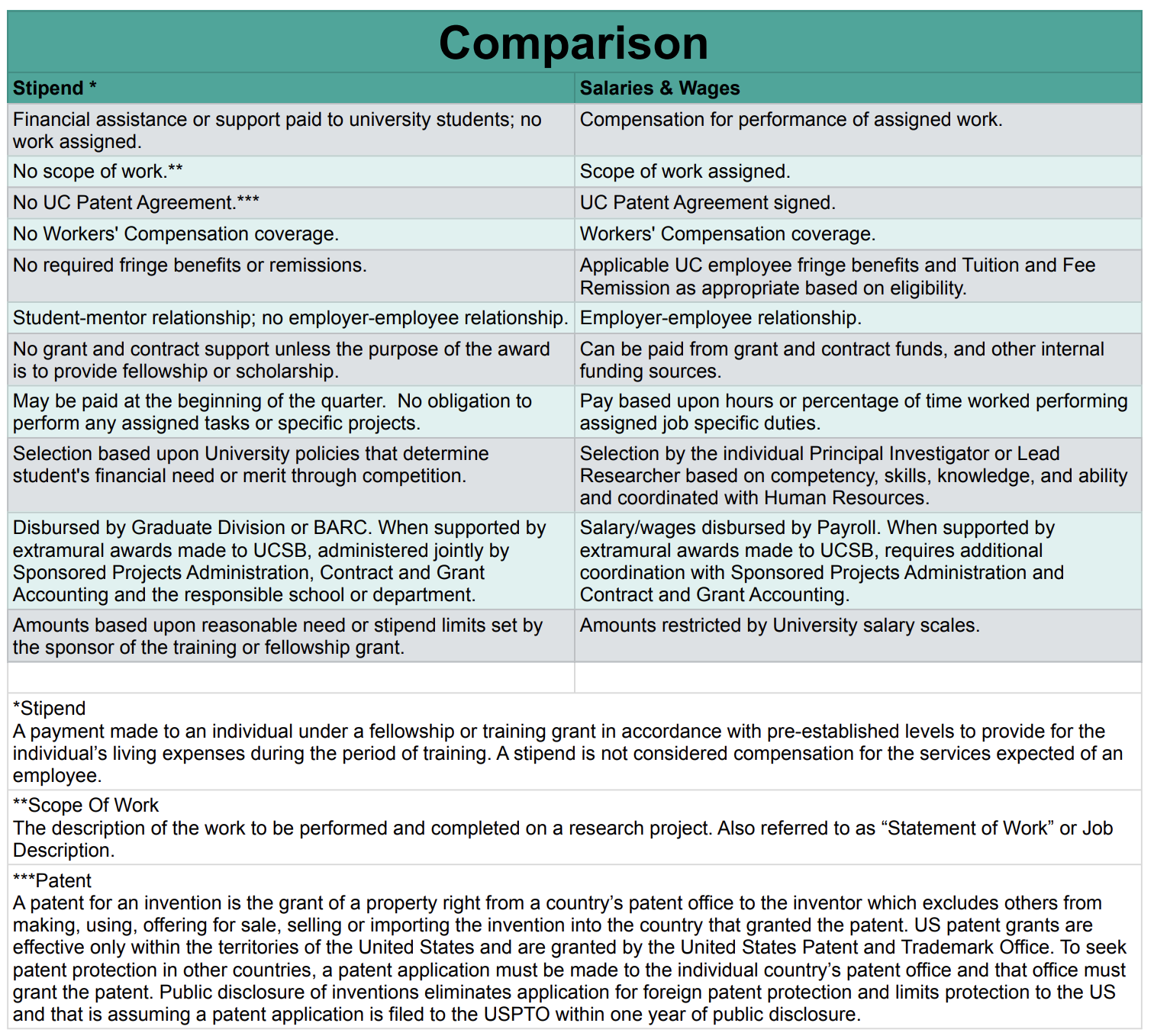

Students may receive university funds through a student aid stipend or employment. It's important to consider the proper method of payment. It should be noted that a student receiving a stipend is not considered an employee.

Stipend student aid payments

To provide a stipend to a student, please complete the "Student Award/Stipend Request Form," which can be found on the Forms webpage. Submitting this request will enable SASC staff to work with GradDiv or the Office of Financial Aid to administer the student stipend. Please note that the processing time for the request may take 1-4 weeks, depending on factors outside of SASC's control.

Hiring and paying salary/wages

To hire a student, please complete the Student Hiring Request Form, which can be found on the Forms webpage. It is important to submit the request form at least two weeks before the student is scheduled to start working. This will allow one week for SASC staff to initiate the hire in UC Path and another week for the UC Path Center to fulfill the hire.Please bookmark the Kronos Timekeeping Logon and the Timekeeping Calendar.

The Student Employment Guidelines chart can be found here. Note that federal law requires completing the USCIS I-9 Employment Verification prior to working, and failure to comply with this federal requirement will result in termination and create payroll issues.

a) If the new hire has never worked on Campus, they must complete their Employment Verification: USCIS regulations state that Section 1 of the I-9 is required by the employee's first day of work. Their Section 2 documentation ID is required no later than their third day of work.

b) Employment Verification I-9 Section 1: New hire will receive an email from: employment.authorization@universityofcalifornia.edu <i9complete@trackercorp.com> to their UCSB email account from I-9 Tracker to fill out section 1 of the I-9.

c) Employment Verification I-9 section 2: New hire must bring to SASC their original valid identification. Please see the list of I-9 Acceptable Documents. All documents must be UNEXPIRED.

d) Complete State Oath of Allegiance. A witness will need to be present with the employee (virtually or in person) and read aloud the Oath while the employee repeats it back to the witness.

International Students

Nonresident Alien Payments

As an international student, you will receive an email from GLACIER regarding the documentation and reporting of payments made to nonresident aliens. The University is required by federal law to collect information about a payee's foreign status. Beginning in 2008, the University started using GLACIER, a secure web-based nonresident alien tax compliance system for foreign visitors to document their immigration and tax data. This information is provided by UCSB BFS- Non-Resident Alien Information.

Graduate Students

Graduate students may be hired as Student Assistants or Graduate Student Researchers. Generally, faculty members have the flexibility to determine the pay for students if they plan on using their own funds. The hourly pay can vary depending on the type of position the student will hold, the faculty member's/PI's budget, and the duration of the project. At SASC, the hourly pay for a Student Assistant position can range from the minimum wage to ~$27 per hour. The number of hours per week also influences the pay amount as determined by their supervisor, with fewer hours often resulting in higher pay. A GSR appointment is a monthly appointment; please reference Red Binder IV-10 for more details. The GSR position is a UC graduate student who performs research related to the student's degree program in an academic department or research unit under the direction of a faculty member or PI. The current Salary Scale for GSR can be found here.

Undergraduate Students

Undergraduate students are always employed in Student Assistant 1 (STDT1) positions.

UC Path

UC Path impacts how student employees are paid and when they can start work. Several resources are available to help student employees navigate UCPath. UC Path log in requires UCSBNet ID. Access to UCPath and many other campus systems requires multi-factor authentication (MFA). Our campus uses Duo Security software for MFA. Instructions for setting up MFA can be found here: https://www.it.ucsb.edu/mfa. From there you will be directed to your “Dashboard.”

Employees are encouraged to take action on their Dashboard to ensure accurate and timely pay. The following checklist is important and will help avoid any delays.

1. Set up Direct Deposit. Follow these steps: Employee Actions” → “Income and Taxes” → “Direct Deposit.”

2. Fill out W-4: Federal Withholding Form. Follow these steps: “Employee Actions” → “Income and Taxes” → “CA State W-4 (DE-4). Also do Federal”

3. Sign the Patent Agreement Form. Follow these steps: “Employee Actions” → “Personal Information” → “Patent Acknowledgement.”

Other actions:

To disclose your disability status, use the following path: “Employee Actions” → “Personal Information” → “Disability Status.”

To disclose your veteran status, use the following path: “Employee Actions” → “Personal Information” → “Veteran Status.”

To disclose information about your gender identity and sexual orientation, use the following path: “Employee Actions” → “Personal Information” → “Gender Identity and Sexual Orientation.”

Kronos and paycheck

Kronos is UCSB's online timekeeping platform for tracking and reporting hours worked and leave time taken. Employees, supervisors, and payroll managers all have a vital role to play in the time keeping process. Employees in non-exempt positions (ie. STDT1) are generally considered "biweekly employees" meaning timecards are due and paychecks are provided on a biweekly schedule, unless the employee is also in an exempt position (ie. TA) then paychecks are provided on a monthly basis because the exempt position takes presidence. Here is a link to UC's Payroll Calendar.

Non-exempt employees record hours worked in Kronos, which can be accessed at https://timekeeping.ucsb.edu. Log on to the timekeeping web portal requires a UCSB NetID.

On the days worked, select “Hours Worked” in the “Pay Code” column and enter the total hours worked in the “Amount” column. Our departments does not utilize the timestamp function, so information should not be entered in the “In” or “Out” columns.

To approve the timecard at the end of the pay period, click the the “Approve Timecard” button on the left side of the timecard screen.

After the timecard is approved end of the pay period, the employee's supervisor should review and approve the timecard.

Student employment-related questions should be directed to the appropriate financial staff member found in the People webpage.